Filing of returns is not a new concept. Since 1992, every individual with a PIN has been required to file their income tax returns for every year of income by 30th June of the following year. This is a statutory requirement that if not met will attract penalties. Filing of returns also helps you to ascertain that what was deducted from your income as tax by your employer was actually remitted to KRA.

In August 2015, KRA issued a public notice making it mandatory for persons to file their income tax returns online via iTax, the Integrated Tax Management System. While this was meant to simplify the filing process by giving us a chance to file our tax returns from the comfort of our homes or offices, Filing of tax returns is still an uphill task for many. Probably because some of the basic concepts behind income tax filing are not clear.

First of all, you will require the following:

- An internet enabled device.

- P9 form from your employer.

- KRA PIN.

- iTax password.

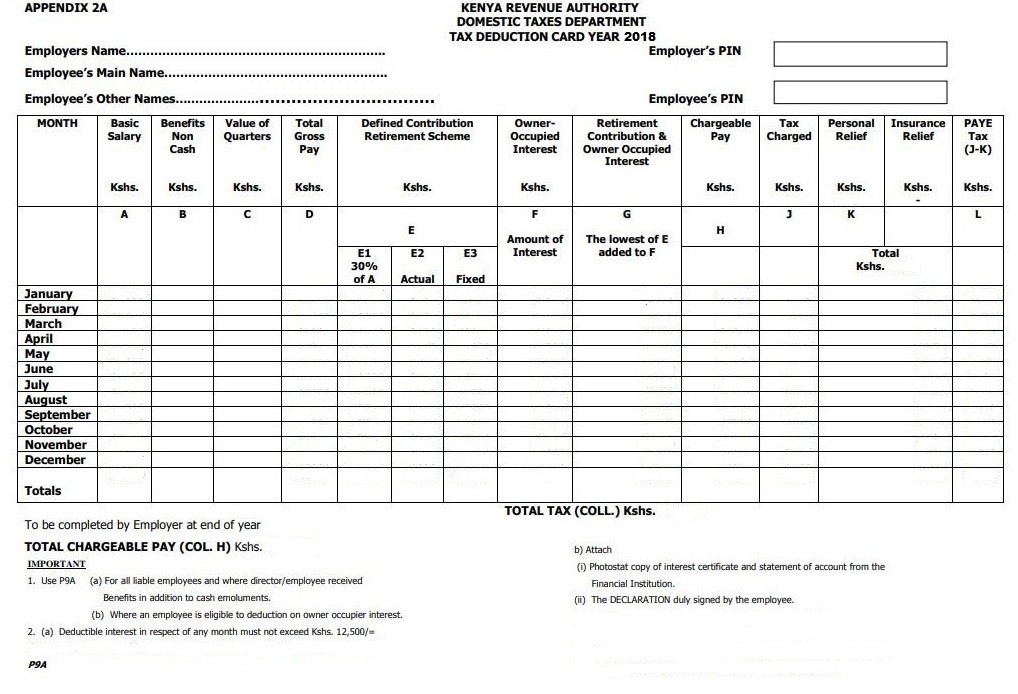

A P9 is a form containing total income received in a year and may include the following depending on the structuring by the employer; basic salary, allowances and benefits, gross salary, pension contribution, PAYE charged and personal relief entitlement. Below is an image of a standard P9.

Gross pay is the sum of your basic pay and any other taxable allowances and benefits received as a result of employment.

Pension contribution, Mortgage interest and savings in a home ownership savings plan (HOSP) if any are deductible contributions. They are therefore deducted from your gross pay before arriving at the taxable income. These amounts should be captured in their respective sections on the online return form. Failure to capture these correctly on the form, will result in tax payable at the end of the filing process.

The deductible contributions are however subject to various conditions. Mortgage interest or owner occupied interest on an amount borrowed for either purchase of premises or improvement of premises you occupy for residential purposes is deductible up to a maximum of Kshs. 25,000 per month (Kshs. 300,000 per annum).

Savings in a Home Ownership Saving Plan from an approved institution, is deductible up to a maximum of Kshs. 4,000 per month (Kshs. 48,000 per year)

Contributions towards a defined contribution fund such as a registered pension fund, individual retirement fund or the National Social Security Fund (NSSF) is allowable up to a maximum of Kshs. 20,000 per month (Kshs. 240,000 per annum).The deductible amount is however limited to the lesser of:

- 30% of your pensionable(basic) income

- Actual contribution

- Kshs 240,000 (i.e. equivalent to Kshs. 20,000 per month)

An Individual’s taxable income or chargeable pay is taxed on a graduated scale according to the prevailing tax rates in that particular year. As a resident individual you are entitled to a personal relief which is a tax incentive that reduces the amount of tax payable. The current rate of personal relief is Kshs. 16,896 per annum (i.e. Kshs 1, 408 per annum) with effect from 1st January 2018.

If you have a life, health or an education insurance policy, you are entitled to an insurance relief of 15% of the amount of premiums paid for self, spouse or child. However, it shall not exceed Kshs. 60,000 per annum.

With these few tax filing concepts, you are now ready to file your returns. It is important to start the filing process early so that in case you face any challenges that require KRA’s intervention, you have ample time to get it sorted out prior to the deadline.

For further guidance, click here to watch the video on how to file with employment income only. Avoid the last minute rush, file your income tax returns early.

By Sophie Marami

BLOG 30/01/2020