To foster economic growth and development, governments need sustainable sources of funding for its development. Globally, taxes have been the primary source of revenue and essential fuel on which most governments run.

In order to boost revenue collection in Kenya, the Kenya Revenue Authority (KRA) through the Finance Act 2006, introduced a ‘simpler’ tax regime for Micro and small enterprises (MSMEs) dubbed Turn Over Tax (TOT).

Who Should Pay Turnover Tax?

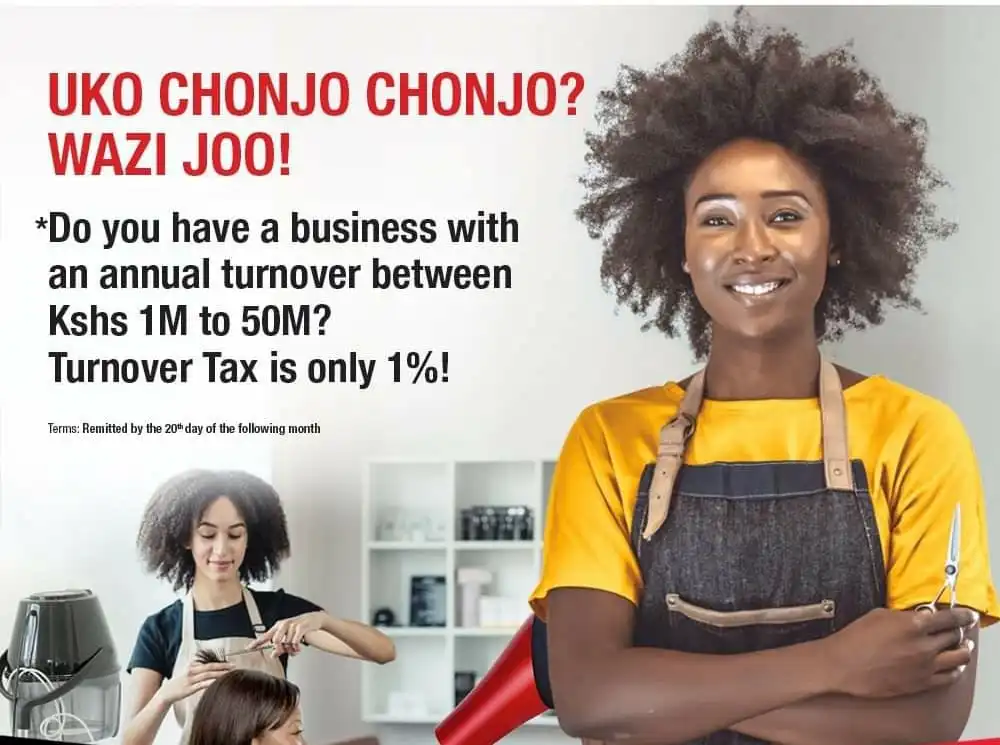

TOT applies to small businesses whose gross sales are more than Kshs. 1,000,000 and does not exceed or is not expected to exceed Kshs 50,000,000 in any given year. TOT is a final tax and it’s payable on a monthly basis of 1% of gross monthly sales, by the 20th of every following month.

Turnover Tax Exemptions

This tax does not apply to, rental income, professional and training fees, and any income that is subject to a final withholding tax. Additionally, Persons with business income below Kshs. 1,000,000 and above Kshs. 50,000,000 per annum are exempted from paying TOT.

Turnover Tax and VAT

However, TOT registered businesses supplying or expecting to supply taxable goods worth Kshs. 5,000,000 and above within 12 months, must register for Value Added Tax (VAT). A nil return should be filed where a business/company does not have transactions (sales and purchases) in a month.

How to File and Pay Turnover Tax

Returning of the Turnover Tax is simple and can be done in five steps: First, Login to iTax. Under the returns menu, select file return, then turnover tax and download the excel return. Once you have completed and submitted the returns, go to the payment menu, select 'payment', select the amount payable, generate a payment slip and make pay. Payment can be made via a partner bank or through M-pesa.

Today, payment has been made easy thanks to KRA M-Service App. The app allows you to file and pay for TOT at the convenience of your phone. This means you can do your business and file taxes on the go. Intrinsically, businesses eligible for the Turnover tax must register for the Turnover Tax obligation on the taxpayer’s iTax online portal.

Turnover Tax offences and penalties

Failure to file and pay Turnover tax by the 20th day of every following month will be penalized. Late filing attracts a Kshs. 1,000 penalty per month, any late payments will attract a 5% penalty of the tax due and interest charged at the rate of 1% of principal tax due on unpaid tax.

In conclusion, I would urge every citizen eligible for TOT to bolster their tax compliance by filing and paying tax in good time.

Dennis Karuri

KRA Tax Education

BLOG 16/11/2021