In a bid to enhance overall tax compliance in Kenya, the Kenya Revenue Authority (KRA) extended a bone to non-compliant taxpayers through the introduction of the Voluntary Tax Disclosure Programme (VTDP) via the Finance Act 2020, which took effect from 01 January 2021 and will run up to 31 December 2023.

What is Voluntary Tax Disclosure Programme (VTDP)?

The VTDP grants taxpayers an opportunity to confidentially disclose tax liabilities that were previously undisclosed to the Commissioner with an aim of being granted relief of penalties and interest of the tax disclosed. The disclosures eligible under this programme will be undisclosed taxes that accrued in the 5-year period from 1st July 2015 to 30th June 2020 and thereafter benefit from a waiver of penalties and interest ranging from a 100% waiver to a 25% waiver of accrued penalties and interest.

How Voluntary Tax Disclosure Programme works

Where the disclosure is made within the first year of the programme, taxpayers stand to benefit from a 100 per cent waiver of penalties and interest. Equally, where the disclosure is made in the second and third year of the programme, taxpayers may benefit from remission of 50 and 25 per cent of accrued penalties and interest respectively.

How to apply for the Voluntary Tax Disclosure Programme

A person who wishes to take advantage of VTDP shall log into the iTax portal, enter your PIN and Password, select the ‘Voluntary Tax Disclosure Program’ under the ‘Returns’ Menu. Taxpayer(s) will be required to select the ‘Tax Obligation’ they wish to seek relief from, enter the Return Period From and Upload relevant Supporting Documents, Enter Undeclared Income, and all other mandatory fields depending on tax obligation and then submit the application.

An Acknowledgement receipt will be issued on submission and an approval task created in the taxpayer’s Tax Service Office. Taxpayer will only be able to make payment after approval has been granted.

Approval/ Rejection of VTDP application

Upon approval/rejection of the application, the applicant will receive approval/rejection notice via their registered email address. For approved cases, the taxpayer shall generate a payment slip (PRN) as per the filed VTDP return and make the payments accordingly (where applicable) and a VTDP certificate will be issued.

The icing on the cake is that person(s) granted relief under VTDP shall not be prosecuted for tax liabilities disclosed under the programme. The applicant may also settle the disclosed tax liability in instalments as agreed with the Commissioner. However, where the applicant fails to disclose the material facts in respect of the relief granted, the Commissioner may withdraw the relief, assess additional tax or commence prosecution.

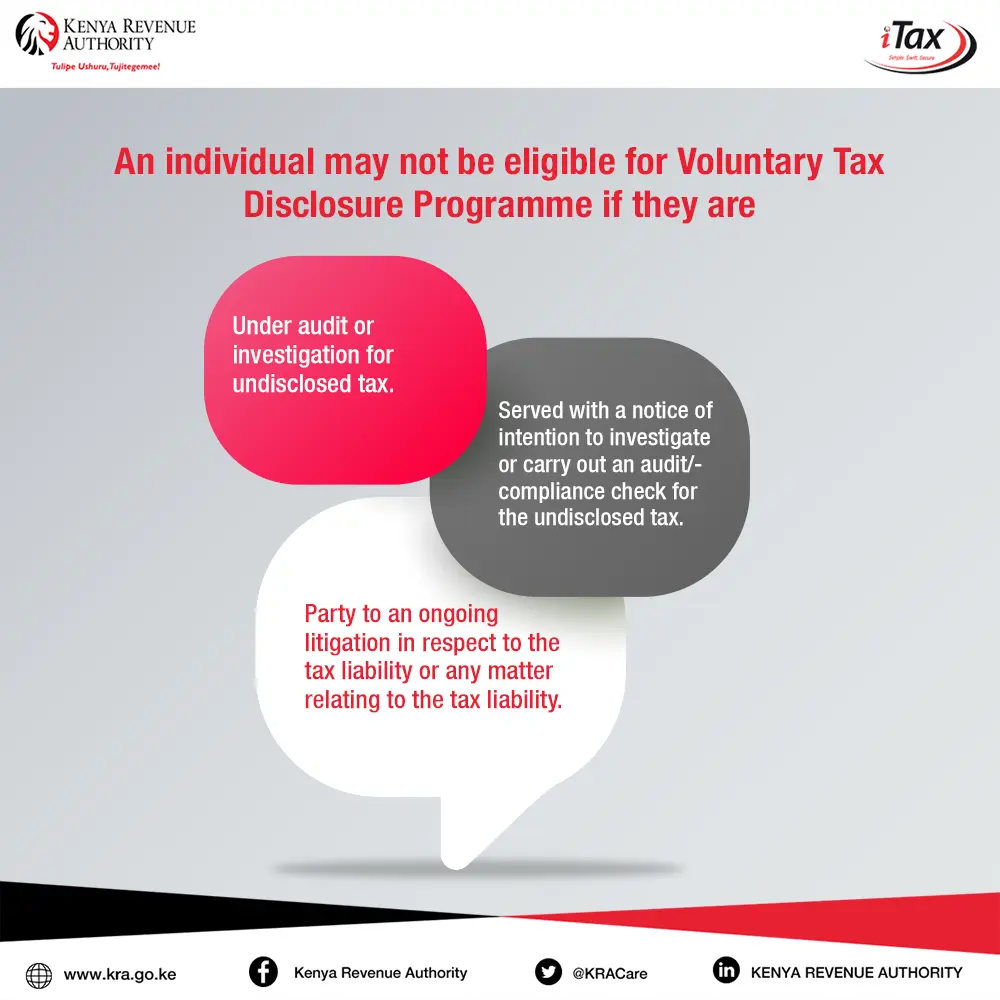

Nevertheless, a taxpayer shall not be eligible for VTDP if he/she is under audit, investigation or is a party to ongoing litigation in respect of the tax liability or any other matter relating to the tax liability.

Conversely, taxpayers shall be barred from taking advantage of the VTDP if the Commissioner of Domestic Taxes has notified them of a pending audit or investigation.

In the medium to long term, it is expected that the VTDP will positively influence the tax compliance status of taxpayers within the country, and similarly boost the revenue authority's tax collections within the period the programme is in effect.

By Dennis Karuri

KRA Tax Education

BLOG 24/03/2022